ADAPT OR PERISH: FIVE STRATEGIC IMPERATIVES TO SURVIVE AND THRIVE IN A POST-INFLATION WORLD

Consumer packaged goods (CPG) companies are increasing prices in an effort to recover margins due to inflationary costs. To illustrate, the ice cream industry in the Netherlands saw an average price growth of 9% in 2022, while the fabric cleaning industry in Sweden experienced an average price growth of 11%. Although scientific research has shown that consumers are willing to pay more for branded products, the ability to keep raising prices to recover margins will eventually reach its practical limits. Eventually, the growth of household incomes will be outpaced by inflation, resulting in reduced disposable income and consumption. Extrapolating from past crises, it is expected that inflation will significantly reduce as a result of a soft landing or a recession (see Exhibit 1).

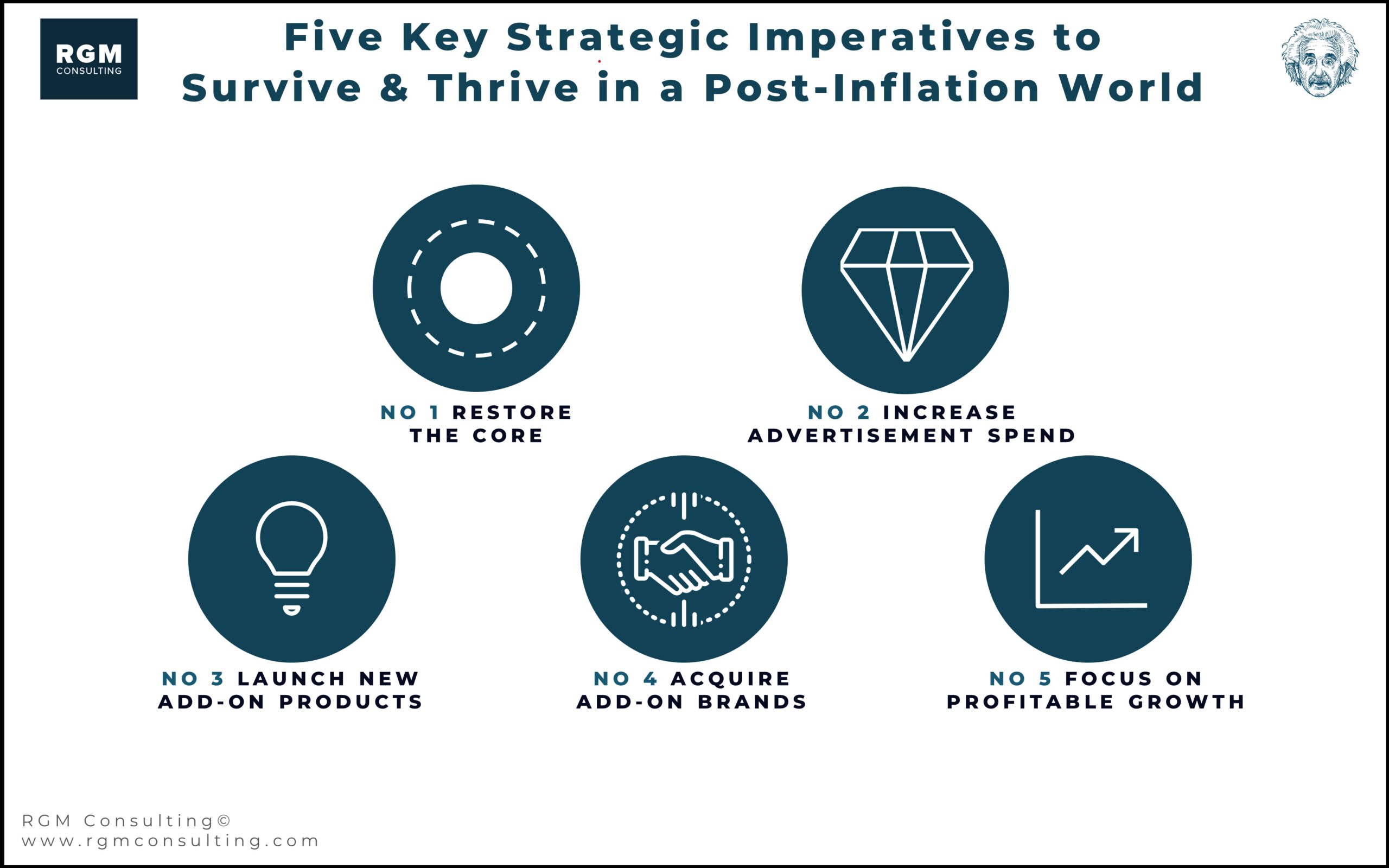

In the Netherlands, for instance, the ‘22 Consumer price inflation is 11.6%, while the ‘22 household income only rose 7.5%. As a result, cash-strapped shoppers are switching to private label, which now have an all-time high value share of 27.6%. Also, retailers have already communicated that they will increase price promotions, reduce prices, or introduce a price ceiling. As retailers are increasing pressure to curb price growth, suppliers are asking to renegotiate contracts, and shoppers are downgrading to cheaper alternatives, CPG players need to know how to survive and thrive in a post-inflation world. To help do that, we have developed five strategic imperatives that can help boost performance while laying a foundation for an ongoing competitive advantage (see Exhibit 2).

NO 1 RESTORE THE CORE

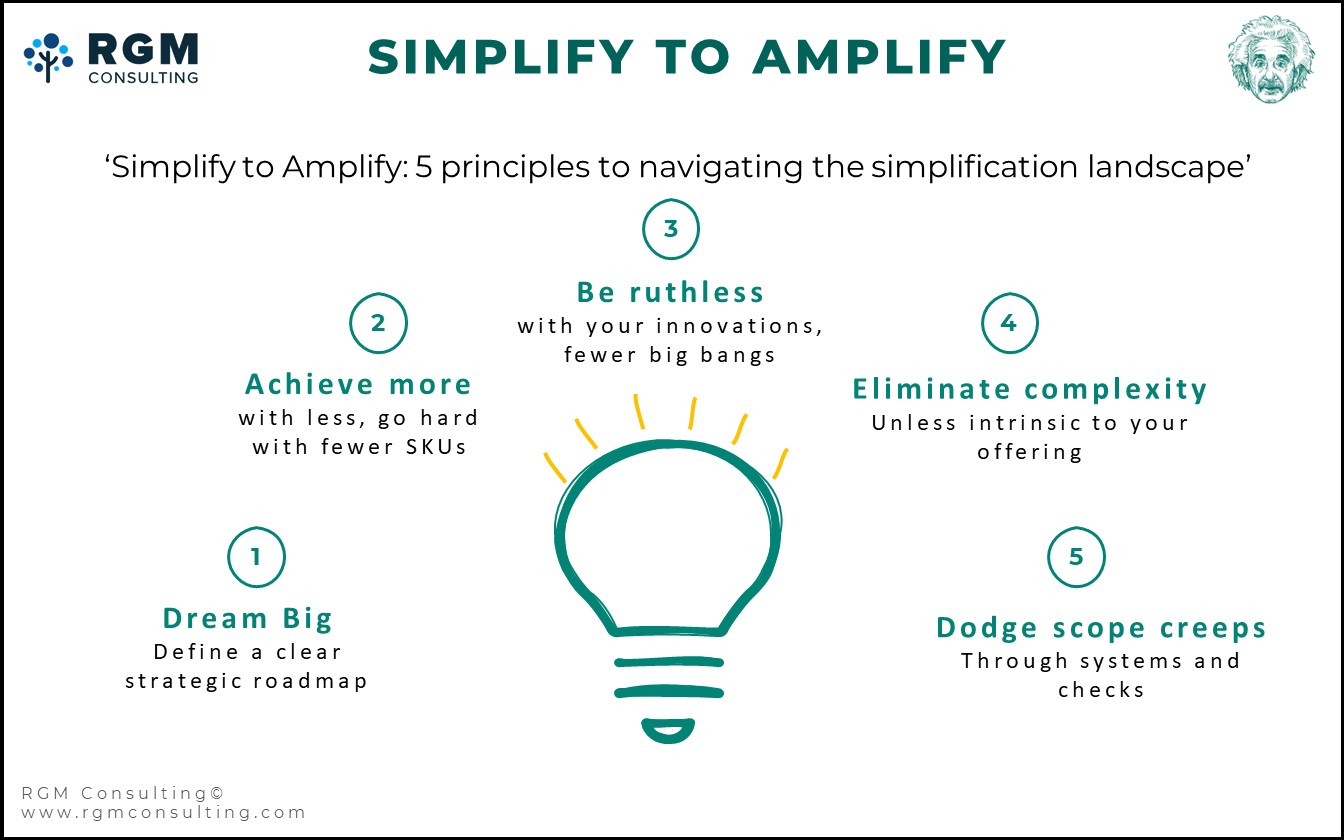

The idea to focus on a specific set of activities in order to build a comparative advantage or reduce complexity is not new. In fact, there are many experts along with us, who believe it can even help firms outperform the market. Conceptually, it is easy to understand that a jack of all trades is a master of none. Interestingly, this topic keeps recurring during times of crises and looming recessions since it’s an excellent way to remove the fluff while keeping the good stuff. From an operational standpoint, restoring the core improves efficiency by rationalizing product specifications, decreasing manufacturing complexity, improving asset utilization, and minimizing capital tied up in slow-moving inventory. From a commercial standpoint, restoring the core improves sales effectiveness by enabling CPG players to dedicate valuable shelf space to growth accelerators and make sure each item drives value for a specific set of shoppers using the pack price architecture.

Growth Accelerators: To harmonize your portfolio, you need to understand which items form the growth accelerators and which ones the growth inhibitors. Identifying both enables you to maximize shelf space for accelerators and delist inhibitors. However, we must know how to recognize accelerators and inhibitors. We recommend starting with the 20%–30% of items that make up 60%–70% of your sales. Those are your current core products. After identifying the current core, the strategic role of each remaining item has to be mapped to verify if it is a future core or category development item. Once completed, you should have a list of remaining items that do not contribute to growth and do not have a strategic role in the portfolio. Those are growth inhibitors and can be delisted (see Exhibit 3).

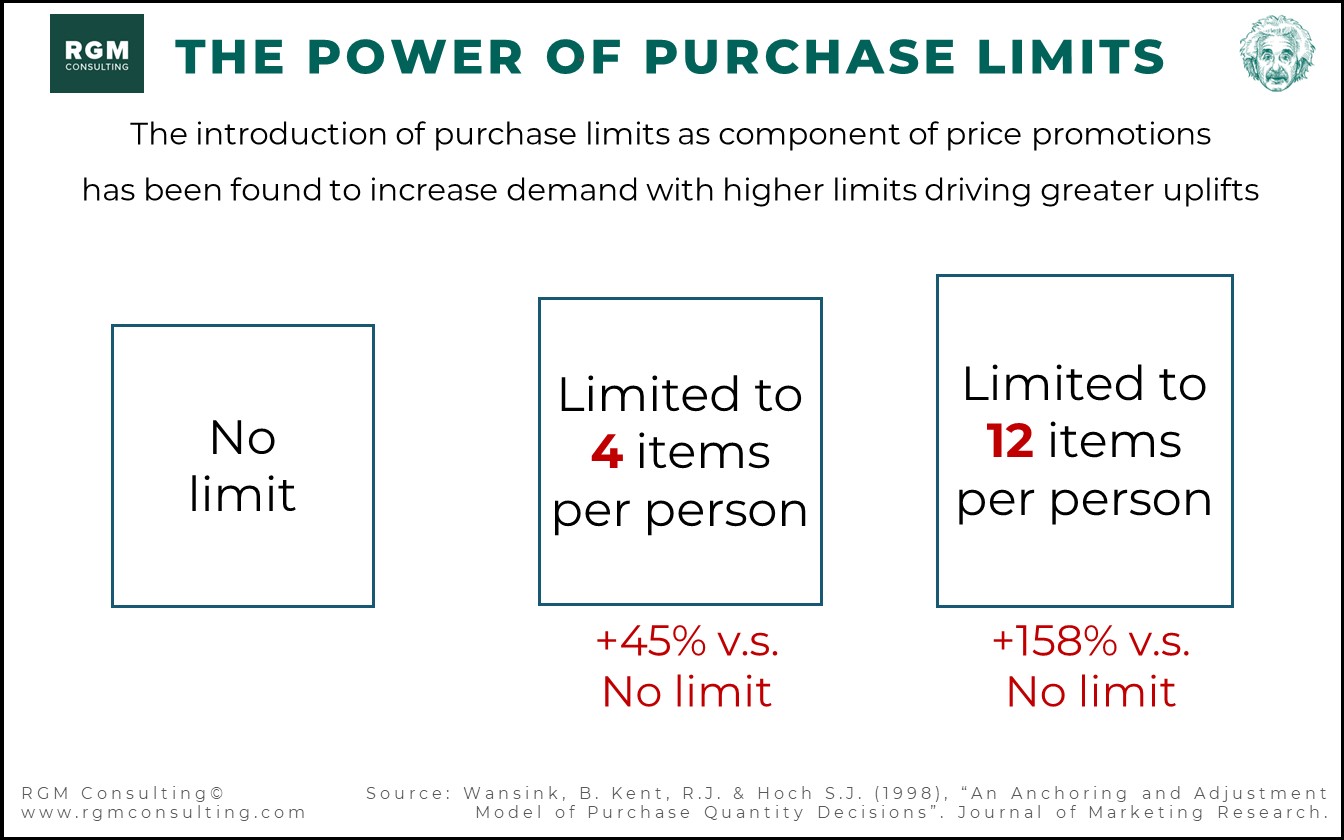

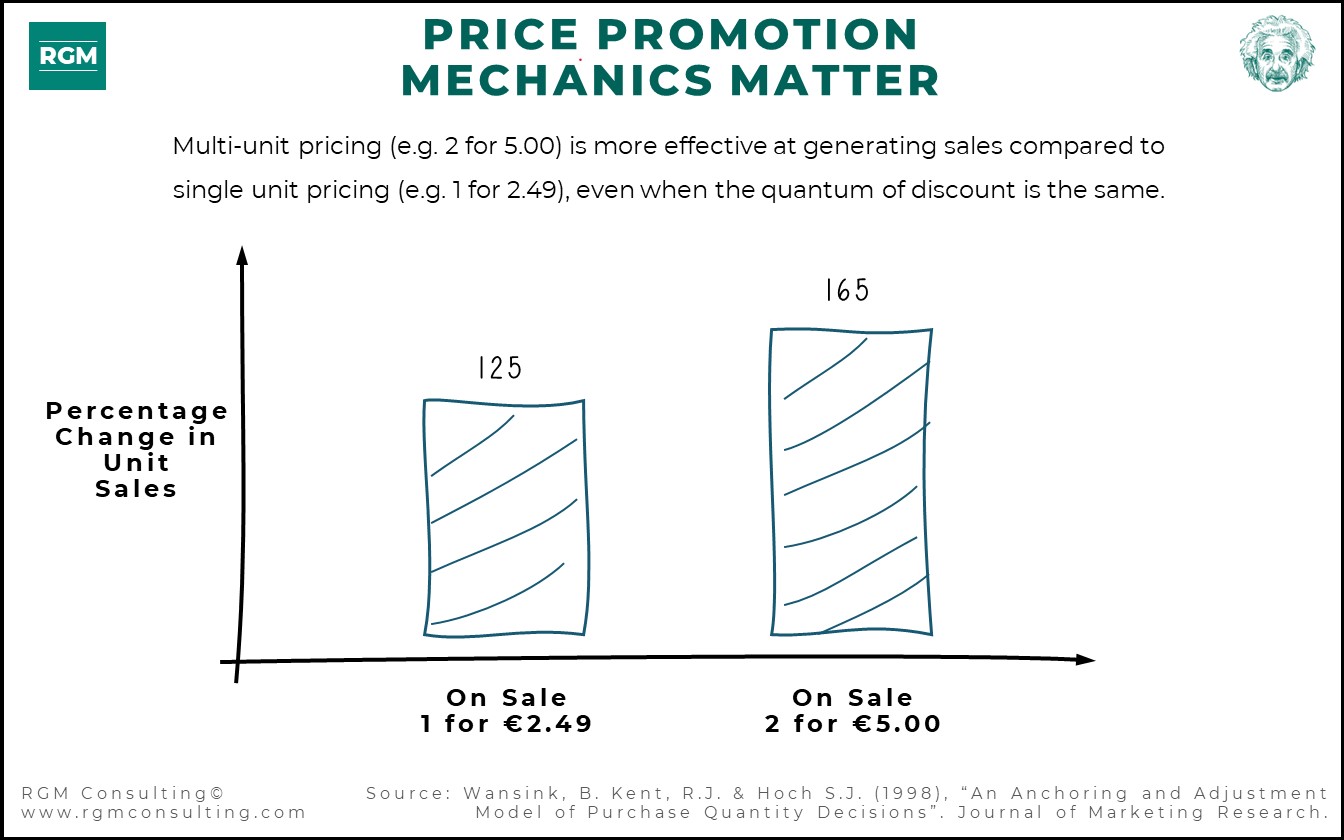

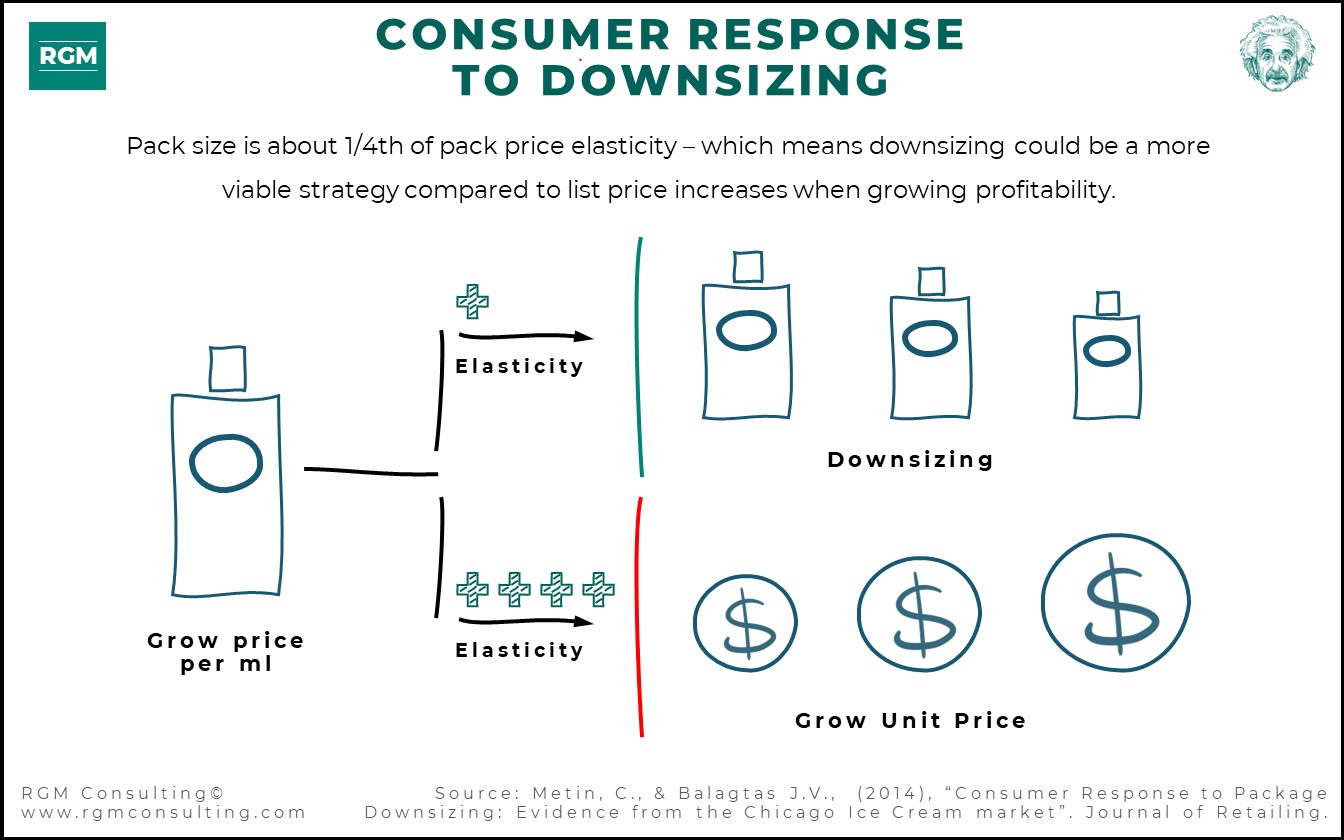

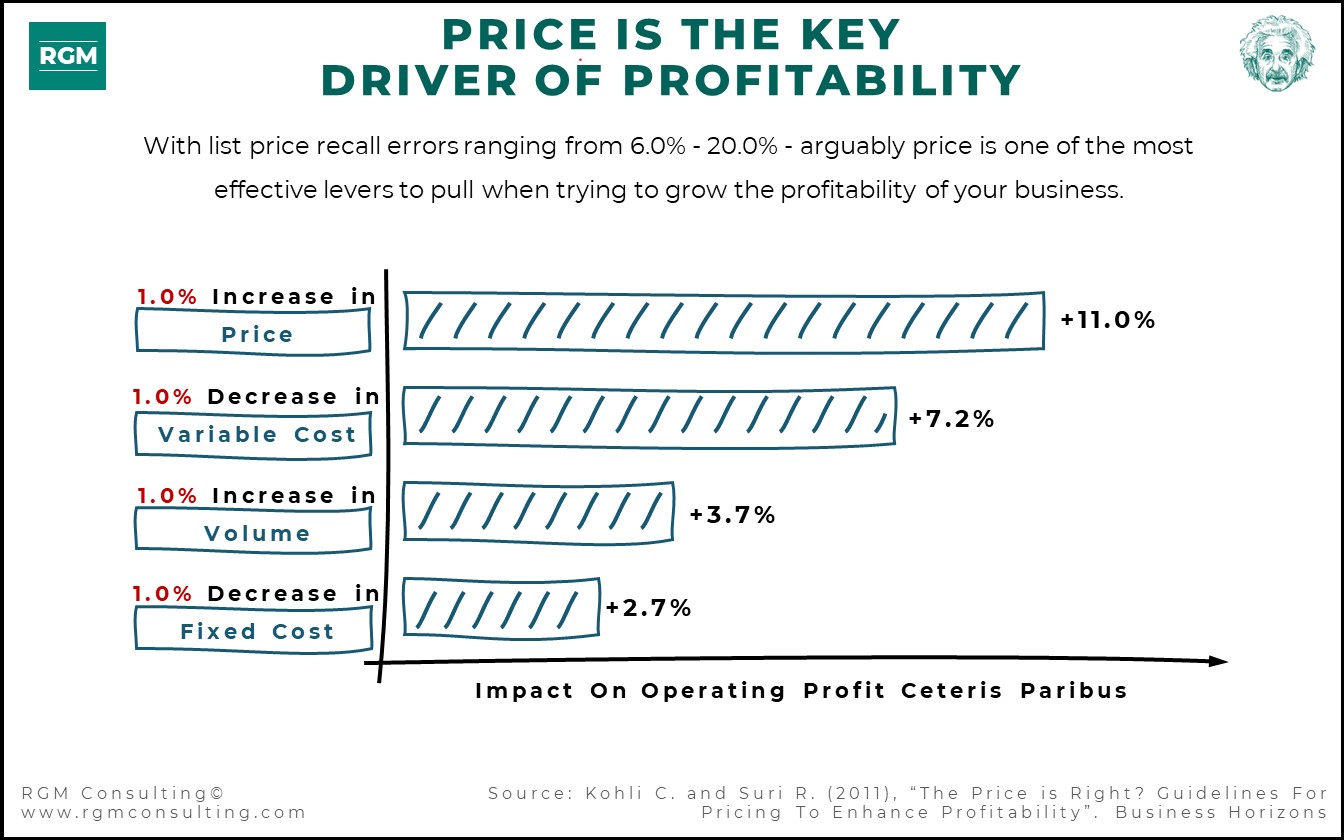

Pack Price Architecture: After delisting, you can make a map of the price gaps to identify which key price points are underserved. You can use the price maps to help recalibrate the pack price architecture (i.e., adding sizes to create more affordable options or pushing existing packs to lower prices). As you decide between changing pack prices or sizes, it’s important to note that research has shown that size changes lead to less volume losses compared to pack price changes. That can be partially explained by the complexity of the arithmetic required to determine the size of the price change given the volume reduction when standing in front of the shelf, especially if it involves changes in all three dimensions (width, height, and depth) and by the inability of consumers to accurately recall historical product prices. That means size changes are a viable strategy to pass cost inflation on to consumers using less obvious price increases while maintaining an image of fair pricing.

NO 2 INCREASE ADVERTISEMENT SPEND

For most companies, the brands they own are their most important assets. However, when the margin needs to be recovered, companies tend to slash marketing expenses. Interestingly, building brands that shoppers can recognize and trust is still the best way to reduce financial risk. In fact, firms that maintain or even increase their share of voice in downturns capture market share from weaker rivals. That means managers need to be smart about which expenses to cut and how to use their brand’s core assets to reinforce its core proposition when navigating economic cycles.

Spend Optimization: During downturns, marketing managers must do more with less. As mentioned, indiscriminate cost-cutting can be detrimental to firm performance. Instead, businesses should focus on optimizing their marketing spend in a smart way in order to optimize their return on investment and share of voice. One way to optimize marketing spend is to shift resources from above the line to below the line advertisement for which the return on investment is easier to measure through attribution modeling such as search-related advertisement, search engine optimization, content marketing, and retailer-specific activations like second placements, in-store advertisements, and product demonstrations. That being said, above the line activities remain important as brands that are out of sight on broadcast media and will sooner or later be out-of-mind for a large percen-tage of shoppers. Smart ways to optimize above the line spending could include reducing the duration of television spots, substituting radio advertisements for television, extending existing or cycling old campaigns rather than commissioning costly new ones and avoiding long-term media commitments so you can benefit from fallen rates.

Core proposition: By reinforcing the core proposition of your brand using reassuring messaging that demonstrates empathy, you can help strengthen the mental memory structures associated with your brand. Empathic messages must be backed by actions that show the brand is on the shopper’s side. For example, reducing quality while raising prices in times of crisis will not help generate a feeling of trust and reliability. Conversely, highlighting the differentiated core proposition of your brand through storytelling focused on delivering value for the shopper at fair prices can foster trust and enhance brand recognition. Food-related brands, for example, could create con-tent that shows consumers how they can use their quality products to create cost-efficient meals. Laundry brands could showcase how their brands help reduce washloads, thus saving on electricity and extending the life of the clothing.

NO 3 LAUNCH NEW ADD-ON PRODUCTS

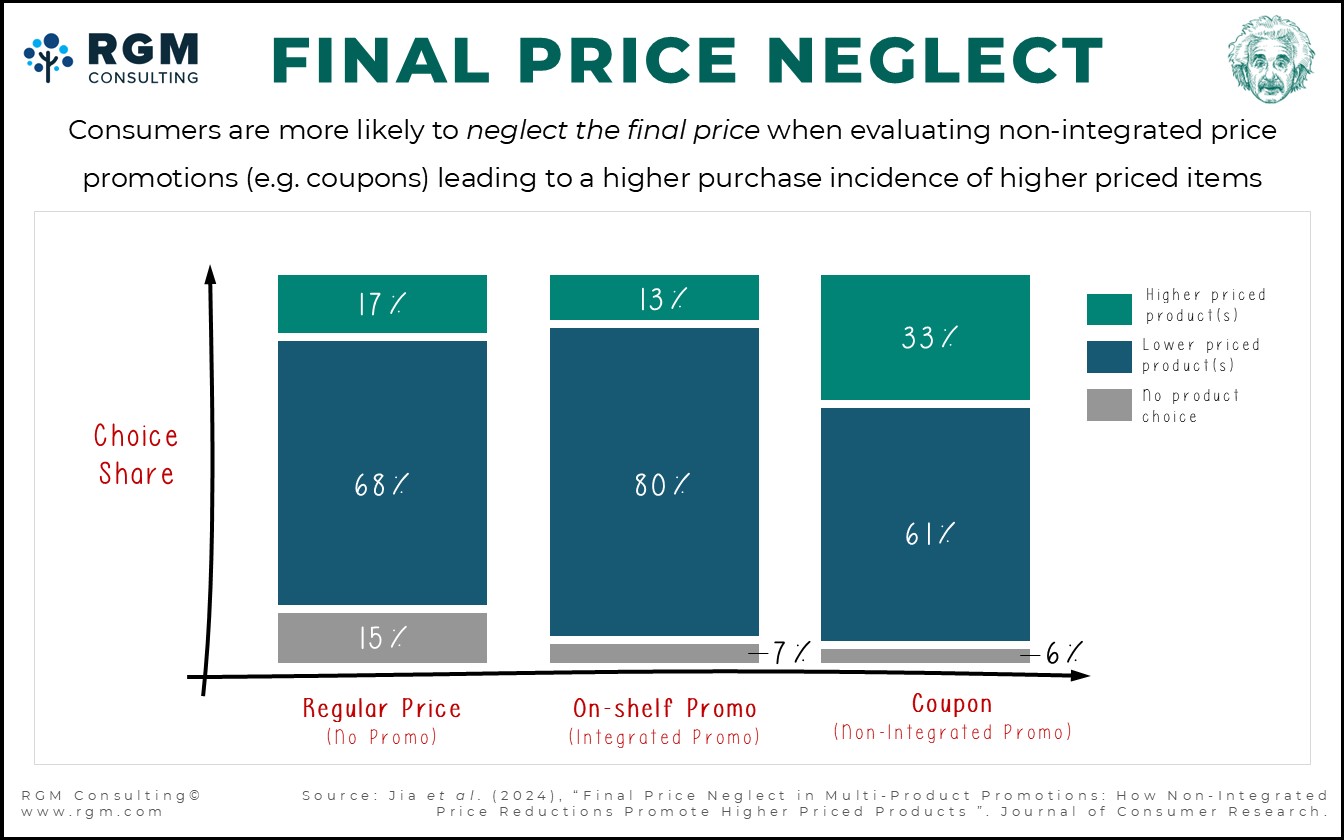

Category leadership encompasses more than attaining the highest share. While short-term measures such as temporary price reductions, volume discounts, and coupons can boost share, their long-term measures such as innovation help build a sustainable, competitive advantage. Understanding what drives incremental growth is an easy way to prioritize the type of innovations to go after. In addition to understanding what drives growth, you can also use new features to create good-better-best (G-B-B) offerings. A well-designed G-B-B architectture can help target shoppers across income groups or target consumers who value features differently (see Exhibit 4).

Growth Maps: Diversifying can help generate new income streams while reducing commercial risk. Great exam-ples of number-two engines are Apple Wearables, Disney+, Nespresso, and Amazon AWS. Diversification also brings risk since resources and attention need to be stretched across business units. Thus, it’s important to understand what your points of differentiation are and how these, in combination with your scale, can be leveraged to beat the competition. To identify what consumers value, you first need to invest in market research that maps consumption occasions, habits, and attitudes. Having a deep understanding of how consumers interact with the products in your category and what they value allows for the creation of growth maps that segment products and charter white spaces. Is that new experiential flavor really driving differentiation, or would it be more effecttive to introduce new formats to tap into different occasions? Once segmented, the size and growth in combination with your organization’s capabilities can be used to determine which white spaces to target and which are too challenging to enter due to competition or brand extension limitations.

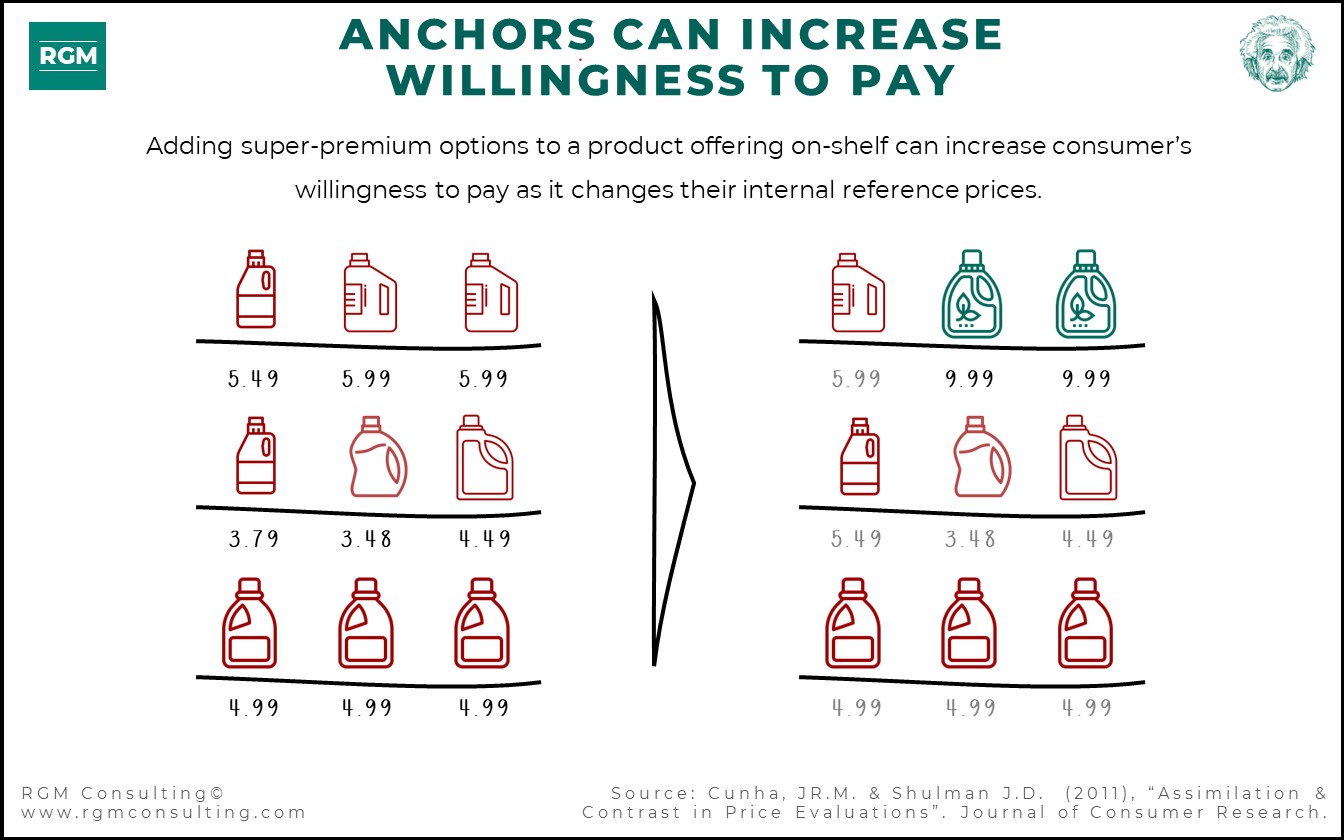

Good-Better-Best: Unbundling features is a great way to create offerings across price tiers. As such, unbundling can help improve margins by adding more premium options to the portfolio, grow revenue by boosting the overall brand image, and drive profits by making the brand accessible to price-sensitive shoppers. For example, laundry detergent brands could have as their basic option a generic offering for all types of clothes, a premium offering that differentiates treatment based on colors, a specialized offering that targets specific fabric types, and unique benefits such as stain resistance (see Exhibit 4). In doing so, the benefits are clearly differentiated by each tier with blockers in between, thereby reducing the substitutability of the products and minimizing cannibalization. Also, the new features would position the brand as a specialist in the eyes of the shopper, making the choice between products easier due to the differentiated propositions and in all likelihood increasing the overall willingness to pay.

NO 4 ACQUIRE NEW ADD-ON BRANDS

Firms with deep pockets can make cost-effective acquisitions to strengthen their brand portfolios, build economies of scale, or expand into new channels or regions. Before trying to acquire brands, the investment thesis needs to clearly define how the target company can strengthen the company’s basis of competition. When Coty bought P&G’s beauty brands, for example, it managed to bring together a powerful portfolio of brands while increasing its operating margin by 500 to 600 basis points. On the flip side of that coin, companies also need to think strategically about which brands to retire. A notable example is the retirement of Lipton Tea from the Unilever portfolio. The deal, which generated 4.5 billion euros, enabled the company to focus on the brands in the portfolio that were growing the fastest and thus unlocked cash that could be used for add-on acquisitions.

Brand Acquisition: It is often said to “never let a good crisis go to waste.” In the context of mergers and acquisitions during downturns, it means that weaker companies can be acquired by stronger rivals in a time when premiums are down. However, empirical evidence suggests that the bargain period is relatively short, and deal multiples show a V-shaped recovery after a crisis. That means you need to start searching for potential targets as soon as economies start showing signs of impending recession. That way, an offer can be made as soon as deal-making activity starts slowing down. When searching for potential targets, it’s imperative that leadership teams define a clear set of selection criteria linked to their overall strategy. It ensures that it is clear what revenue, costs, and financial synergies can be achieved and the sum of the value of the combined companies are worth more than it would be if both companies operated independently. It also helps convince investors and target company management teams that their brands are better off in your care.

Brand Divesture: When faced with underperforming brands, you can follow one of three strategies: sell, squeeze, or turn-around. In many cases, companies are unwilling to sell but do not have the right resources to turn the business around. As a result, they hold on as the value of the brand dwindles. To avoid this trap, you regularly need to ask if the brands in your portfolio are helping your company position for long-term profitable growth and which brands would be better off in another company’s portfolio. Take, for example, the acquisition by Ferrero of Nestlé’s U.S. confectionary business. The U.S. confectionary business only represented 3% ($900 million USD) of U.S. Nestlé Group’s sales, whereas the brands would enable Ferrero to become the third-largest player in the market, to enter new segments, and to leverage its knowledge of the confectionary market to further grow its brands. Moreover, the transaction allowed Nestlé to start moving away from unhealthy products and reinvest the $2.8 billion they made from the sale into categories where they saw strong future growth potential and where they held leadership positions such as pet care, infant nutrition, and coffee.

NO 5 FOCUS ON PROFITABLE GROWTH

Many consumer goods companies use sales growth and market share as key measures of success. That can lead to poor decision-making since it values all share points equally and does not acknowledge the importance of profitable growth in long-term economic value creation. Additionally, we have seen our clients’ leadership teams justify overinvestments in unprofitable market segments with the promise of future market share gains or attaining a leadership position, despite having sales growth, operating profits, and margins as key performance indicators. Escalation of commitment biases are pervasive but can be prevented by installing growth investment boards that focus on the one metric that matters — profitable growth.

Profitable Growth: Within our RGM Consulting community, we often talk about profitable growth. It is fascinating that there is limited consensus about how to define it. At minimum, it should include a measure of sales growth and a measure of profitability. However, here is where it can get a bit foggy because what does it mean to be profitable? There are some that argue it should focus on margins, while others argue it should also include a measure that captures the value that is created by firms, such as total shareholder returns. We tend to agree with the latter, with some minor tweaks to make it useful in managing the performance of brands or categories on a daily basis. Therefore, we recommend defining profitable growth as growth in revenues and profits over longer periods of time while the return on capital exceeds the cost of capital. More specifically, we recommend that you look at four metrics: (1) the growth in net sales, (2) the growth in core operating margin, (3) the growth in core operating profit, and (4) the ratio of the return on capital to the cost of capital. In doing so, you can ensure that you drive growth in an efficient manner while being able to attract capital in the market to fund future investments.

Growth Investment Boards: The graveyard is rife with examples of companies that went bankrupt because they held on too long to a strategy that was once successful (e.g., Nokia, Block-buster, Polaroid, etc.). Escalation of commitment is a well-documented issue rooted in the human psyche that describes people’s tendency to stick to past decisions no matter how irrational they are. With an ever-growing range of investment options, it is no wonder executive teams that have been with a company for many years face challenges making the right trade-offs when allocating resources. To solve this, we recommend installing investment committees. Each committee should be composed of a diverse set of experts from various functional areas and geographical regions to ensure that decisions are made objectively. Additionally, a set of decision-making criteria related to profitable growth and strategic fit need to be defined in order to compare and contrast investment proposals. Once resources are committed, systematic post-evaluations help create feedback loops that can be used to optimize future investment decisions.

TO SURVIVE AND THRIVE IN A POST-INFLATION WORLD

History suggests that inflationary periods are followed by recessions. While it’s difficult to predict what will happen, it’s clear that companies that seize the moment can come out on top. However, outperforming the market in downturns is no small feat. In this paper, we have outlined five strategic imperatives that can help CPG players survive and thrive in a post-inflation world. To summarize, the five imperatives are (1) restore the core, (2) increase advertisement spend, (3) launch new add-on products, (4) acquire new add-on brands, and (5) focus on profitable growth. Since each of these actions requires deliberate planning and decisive action, we recommend CPG leadership teams to act now before it’s too late.

ABOUT THE AUTHORS

Pim Kneepkens & Elias Gerges are the co-founders of RGM Consulting. Both are based in the Amsterdam office. Linda Boessenkool is a consultant and is based in the South Africa office.

Ready to Talk ?

Submit your name and email address, a representative of our firm will reach out to you to discuss your support needs.

Together, we will achieve extraordinary outcomes.